Put in an estimate of your recurring bills (perhaps what you paid the previous year for that specific expense) but once the bill comes and you pay it, put the actual amount into your ledger.

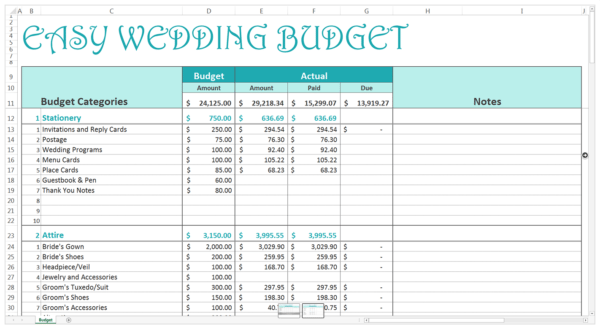

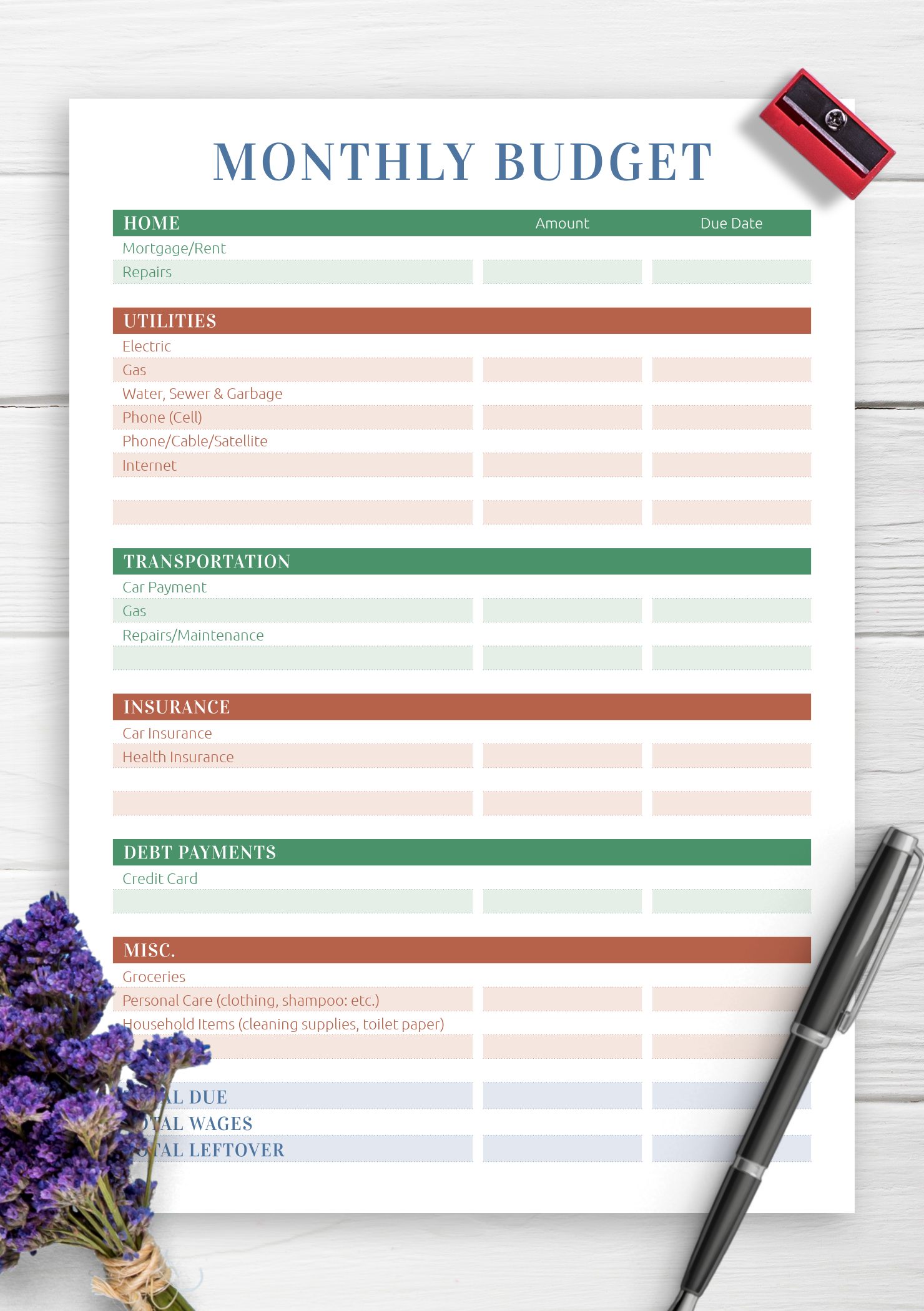

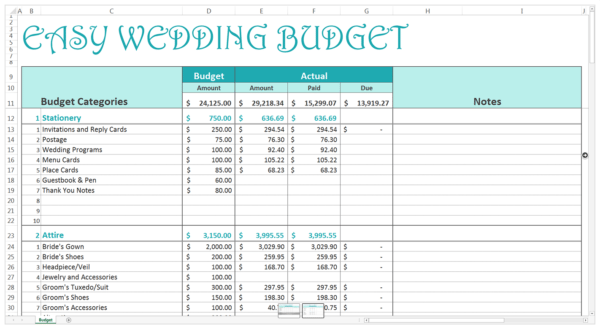

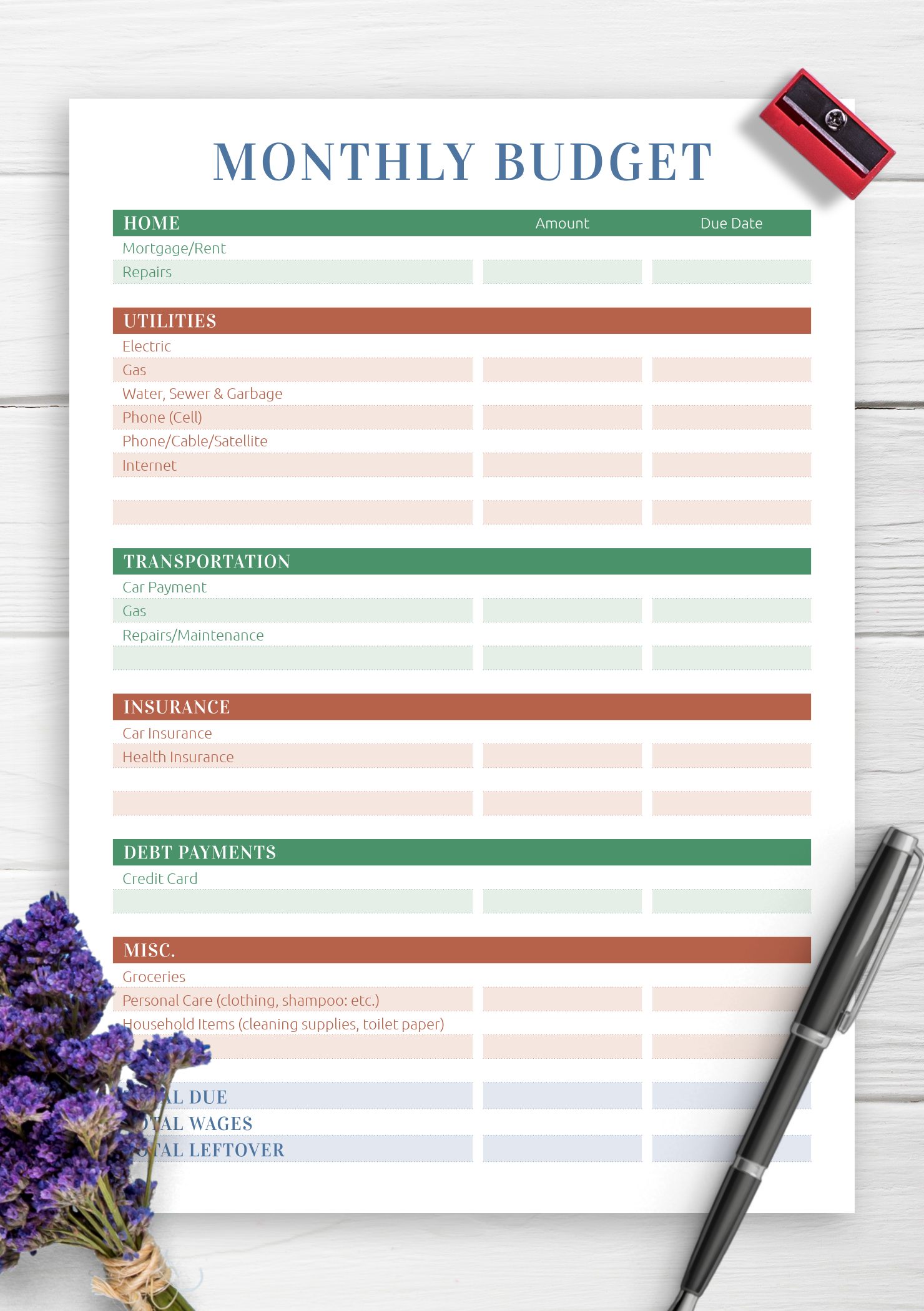

Some bills, such as your rent or mortgage, usually stay the same every month, while others are more variable (like utilities). Put in estimates as placeholders until the actual bills come. Installation payments, such as student loans and credit cards, also go in here. X Expert Source Samantha Gorelick, CFP®įinancial Planner Expert Interview. Some examples would be car payments, rent or mortgage, utilities (such as water, electricity, etc), and insurance (medical, dental, etc). Put your biggest regular expenses into the spreadsheet or ledger. BASIC HOME BUDGET SPREADSHEET SOFTWARE

If you are using software you will be able to add rows easily to fit all of your expenses in.

If you are using a paper ledger, you may want to create a separate page for each of these categories, depending on how many expenses you have in each category every month. Software will also allow you to divide your spending into different time periods and priorities. Using a software program to do this has the added benefit of being able to easily categorize the type is spending (groceries, gas, utilities, car, insurance etc) as well as calculating totals in different ways that are useful to understand what, when, where, how much and how (credit card, cash, etc) you spend.

Transportation (car, gas, public transport costs, insurance).Household Operations, such as lawn or maid service.Utilities, such as electricity, gas, and water.Rent/Mortgage (make sure to include any insurance).Common categories include: X Research source This will help you when you go to input your expenses and when you want to look through them for a specific expenditure.

Each entry should go into a category so you can easily see how much you spend on monthly and yearly bills, regular essentials, and discretionary costs.

X Research sourceĬategorize your expenses.

You can also use electronic budgeting software, such as, which will help you keep track of your spending. They will need to be customized for your specific needs but will be easier than starting from scratch. Many spreadsheet programs come with a built-in template for calculating a household budget. However, they are not free, so you will need to invest a little bit of money in order to use one of them. This type of program also has additional features that may come in handy for formulating budget, such as savings tools. Calculations in a simple accounting program, such as Quicken, are virtually automated, as they are made for this type of project. You can find sample budget worksheets from Kiplinger here. You can use a simple pen and paper but it is much easier to use a spreadsheet program or a simple accounting program if you have access to one. Decide how you will document your household spending, earnings, and budget.

0 kommentar(er)

0 kommentar(er)